Q: I'm an Alumni and no longer have access to Self-Service. How can I get my 1098-T form?

A: 1098-T forms are automatically mailed to your last billing address on file before January 31st.

For Alumni that no longer have Self-service access, please email eai-team@massart.edu and IT will set up access for you. This login will allow you to access the 1098-T form.

You can also email Bursar@Massart.edu from your official massart email account to request a PDF copy. If you do not have an Alumni email then we can only re-mail a paper copy.

Q: Why don’t the numbers on the 1098T form match the amount I paid to MassArt during the year?

A: The amount in Box 1 only represents the amount paid for qualified tuition and fees. It does not include payments made for rooms, meal plans, health fees, health insurance, fines and other fees not related to course enrollment.

The amount in Box 1 reports amounts that the student paid in a particular calendar year, therefore the pay date does not necessarily correspond to the dates that the classes were attended.

Q. What semesters are included on my 1098T tax form?

A: Box 1 on the 1098T tax form includes payments made during the calendar year (January 1st- December 31st) for qualified tuition and fees. It is not based on when classes were taken or fees billed to the student account.

Q: I graduated in May, do I have a 1098T tax form for this year?

A: Some graduates will not be issued a 1098T tax form; students who paid their final Spring semester bill before December 31, will not have a 1098T for the year they attended and graduated because they were charged in the year prior.

Q: How much did I pay?

A: Reported in Box 1 is the amount you paid during the year that applied to Qualified Tuition and Related Fees assessed in the calendar year.

Q: How do you come up with that figure?

A: We account for all payments received in the calendar year that were applied to Qualified Tuition and Related Fees billed by the School (January 1st through December 31st only). It does not include payments made for room, meal plan, health fees, health insurance, fines and other fees not related to course enrollment as per the IRS.

Q: Why didn’t the form include what I paid for Spring?

A: Spring term is generally billed in November, and due to be paid in December, and therefore, the charges billed would have been part of the calculations for the year prior 1098T form.

Q: What is reported in Box 1?

A: Payments applied to your account during January 1 through December 31 that total the Qualified Tuition and Related Expenses assessed in the calendar tax year. They include all payments from all sources, such as:

Individual cash, check and credit card payments

Payments from 529 and other investment accounts

Payments from 3rd parties sponsors such as UTC, VA, DCF, etc.

Student loans

Grants and scholarships

Any refunds you received or any payments made that were returned by the maker's bank are reflected as a reduction of these total payments.

Q: What is NOT reported in Box 1?

A: Scholarships/grants earmarked for charges other than Qualified Tuition and Related Expenses such as housing, meals or books

Tuition and fee waivers, which are reported to the IRS as a reduction to Qualified Tuition and Related Expenses

Q: What are my Qualified Tuition and Related Expenses?

A: Mandatory tuition and fee charges that were charged during the calendar tax year (January 1 through December 31) Charges for housing, meals, transportation and insurance are NOT included.

Any tuition and fee waivers you received are reported as reductions of these total charges.

Q: My records indicate I made more payments than what is appearing in Box 1. Why?

A: Payments recorded in Box 1 cannot exceed the total qualified charges reported in the calendar year. Additionally, payments made for earlier terms are not reported, as the charges associated with these payments were reported in the prior tax years.

Q: Does the 1098T tax form include payments made for books and supplies?

A: No, the amount reported in Box 1 does not include payments for books. You should consult with your tax advisor to determine under what conditions (if any) payments for books, equipment or fees should be considered when determining eligibility for educational tax credits. They will not be reported on the 1098T.

Q: What if I have other questions?

A: You should refer to publication 970 from the IRS or talk to a tax specialist.

How to Download 1098-T Form from Self Service:

1098-T Tax Documentation

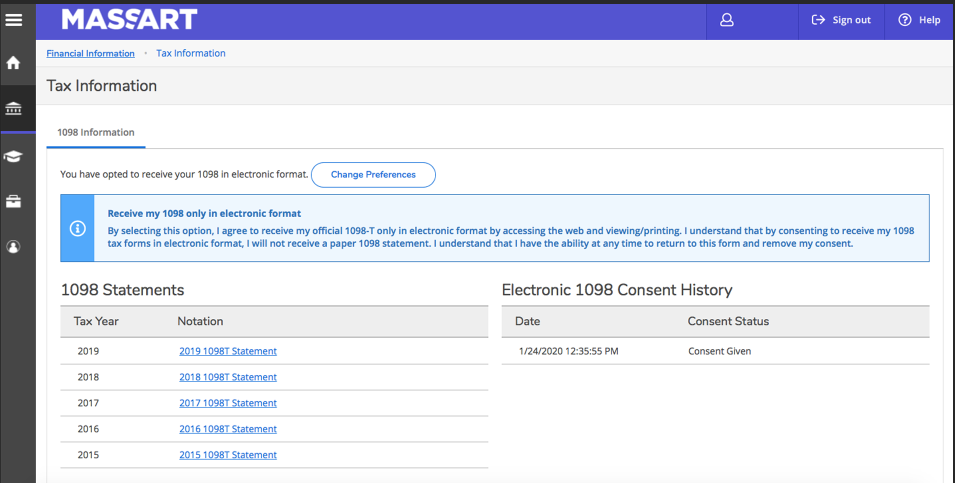

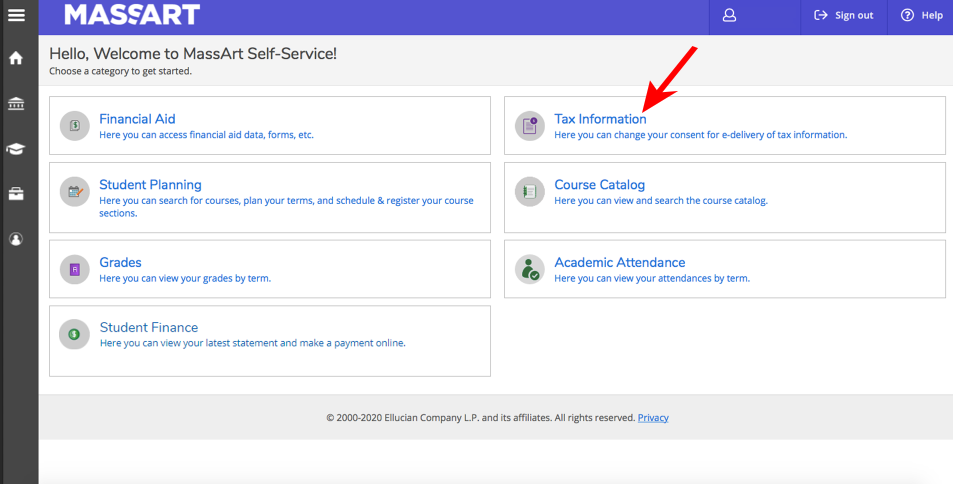

To get your 1098-T Tax documentation, log into Self Service and click on the box labeled “Tax Information.”

Your 1098 T information is available to view or print.